Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market news

Trump may impose tariff exemptions on agricultural products, waiting for U.S. economic data Gold prices help weaken the dollar

Wonderful introduction:

A clean and honest man is the happiness of honest people, a prosperous business is the happiness of businessmen, a punishment of evil and traitors is the happiness of chivalrous men, a good character and academic performance is the happiness of students, aiding the poor and helping the poor is the happiness of good people, and planting in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: Trump may impose tariff exemptions on agricultural products, waiting for US economic data, gold prices are helped by the weakening of the US dollar." Hope it will be helpful to you! The original content is as follows:

Basic news

On Tuesday (July 1, Beijing time), spot gold trading was around $3,311/ounce, and gold prices rose slightly on Monday. As the dollar weakened, investors were waiting for U.S. economic data later this week to assess the Fed's policy direction; U.S. crude oil trading was around $65/barrel. As tariffs eased and boosted demand, investors weighed the mitigation of risks in the Middle East and the possible increase in OPEC+ in August.

Focus on the main central banks in the world during the day

The global leaders (Federal Chairman Powell, European Central Bank President Lagarde, Bank of England Governor Bailey, Bank of Japan Governor Kazuo Ueda, and Bank of Korea Governor Lee Changyong) held a group meeting; the European Central Bank held a central bank forum in Sintra.

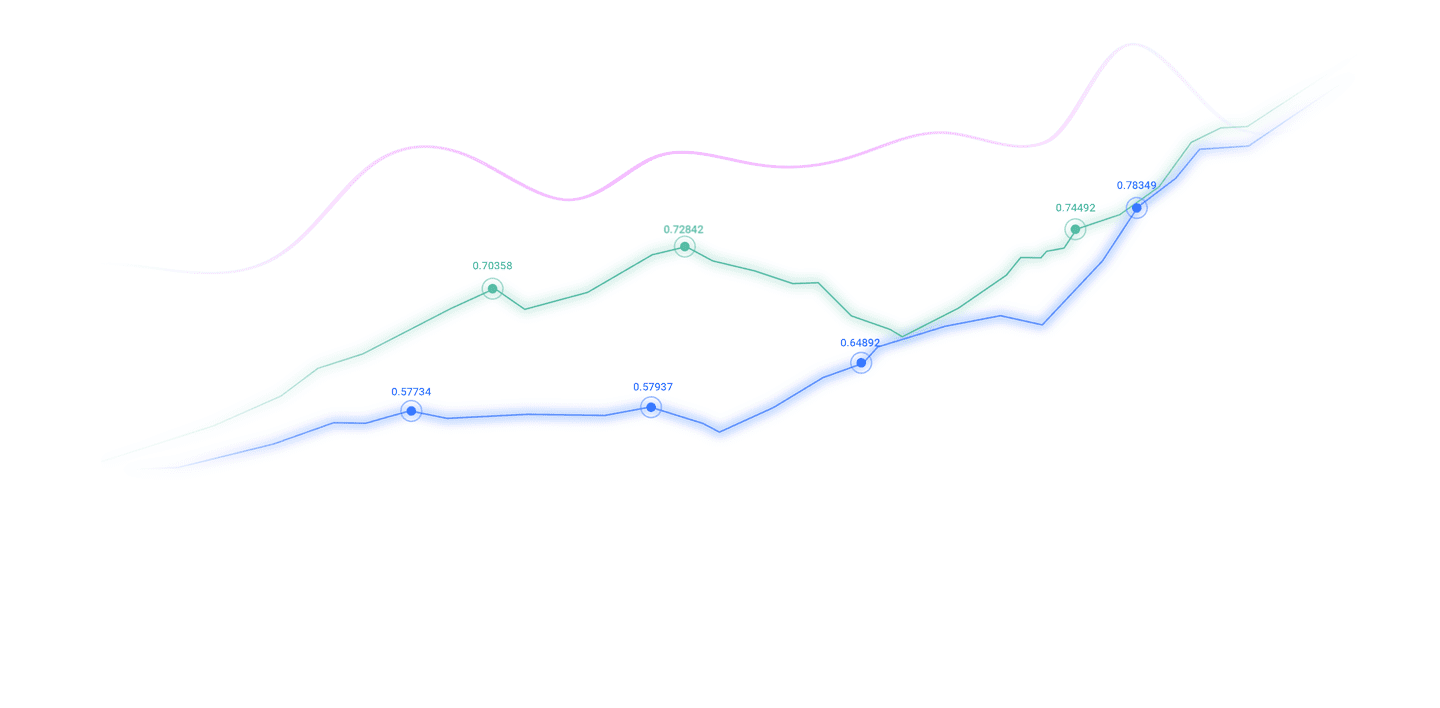

Stock and Nasdaq Index hit record closing highs on Monday, bringing an end to a best-performing quarter in more than a year as hopes for a trade deal and a possible rate cut eased investor uncertainty.

Both indexes ended the quarter with double-digit gains. The S&P 500 rose 10.57% in the quarter, the Nasdaq rose 17.75% and the Dow rose 4.98%. The Russell 2000 small-cap index rose 8.28% in the quarter.

Nevertheless, the three major stock indexes still hit their weakest first-half performance since 2022, as uncertainty in trade policy has left investors on alert this year, and tensions peaked after U.S. President Trump announced large-scale tariffs on April 2.

At the end of this quarter, managers adjusted their investment teamsThe www.xmh100.combined effect made it look more attractive at the end of the quarter, which also had an impact on performance this quarter. "The animal spirit seems to have the upper hand here, and it is www.xmh100.common to see strength due to whitewashing accounts in the last few days of a quarter."

Canadian canceled the tax on Sunday just hours before the digital service tax for U.S. technology www.xmh100.companies came into effect to advance trade talks with the U.S. But U.S. Treasury Secretary Bescent warned on Monday that even if countries negotiate in good faith, they could still face a significant increase in tariffs on July 9, and any possible extension will depend on Trump.

At the same time, U.S. Senate Republicans are working to push for the passage of a massive tax cut and spending bill proposed by Trump, despite the party's disagreement over the bill that could lead to a $3.3 trillion increase in national debt. Currently, the total U.S. debt has reached US$36.2 trillion. Trump hopes the bill will be passed before independence day on July 4.

The key economic data released this week include monthly non-farm jobs and the American Institute of Supply Management (ISM) June manufacturing and service survey report. Several Fed officials, including Fed Chairman Powell, will speak later this week.

A series of weak economic data and expectations that Trump will replace Powell with dovish people have pushed up bets on the Fed's interest rate cut this year.

Nine of the 11 S&P indexes closed higher on Monday. The Dow Jones Industrial Average rose 0.63% to 44,094.77 points; the S&P 500 rose 0.52% to 6,204.95 points; and the Nasdaq rose 0.48% to 20,369.73 points.

The majority of the big U.S. banks passed the Fed's annual "stress test", paving the way for billions of dollars in stock buybacks and dividends, and the shares of these banks rose. In the S&P 500, HP Enterprises ranked the top in the increase, with an increase of 11.1%, FirstSola rose by 8.8%, and Juniper Networks rose by 8.45%. "Although the deficit is rising and policy issues are pending, the current rebound is driven by a handful of heavyweight stocks that drive indexes up, bringing optimism to the market. Stocks don't seem to care at all, and people think the carnival will last forever," he said. "I think the game is over. It's just a matter of how bad the time and the situation is." Gold prices rose slightly on Monday, helped by the weaker dollar, and investors are waiting for U.S. economic data later this week to assess the direction of the Fed's policy. Spot gold rose 0.6% to $3293.55 per ounce, hitting earlier in the session since May 29lowest. Gold prices rose by 5.5% in the quarter, the second consecutive quarter. The settlement price of US gold futures rose 0.6% to $3,307.70. "The weakening of the dollar today provides some support. But we are still in a clear range that has dominated since mid-May."

The dollar fell against the euro and Swiss franc as the market weighed the prospect of a swelling U.S. government deficit and the possibility of a trade deal with major trading partners.

In terms of trade, Canada canceled digital services tax on U.S. technology www.xmh100.companies on Sunday evening to restart the deadlocked U.S.-Canada trade negotiations. Investors are currently awaiting U.S. ADP employment data and initial jobless claims figures later this week to assess the Fed's potential policy path.

Citi analysts said in a report that they expect gold prices to consolidate between $3,100 and $3,500 in the third quarter of this year, noting that the peak of $3,500 in late April may already be the upper end as the gold market shortage approaches its peak.

Spot silver fell 0.1% to $35.93 per ounce, platinum palladium fell 0.3% to $1334.70, and palladium fell 3.2% to $1097.24 per ounce. The balance of the three will rise this quarter. Oil market

Oil prices fell slightly on Monday, with investors weighing the mitigation of risks in the Middle East and the possible increase in OPEC+ in August. Last week, Brent and U.S. crude oil both hit their biggest single-week declines since March 2023. However, the monthly lines of the two rose for the second consecutive month, with an increase of about 6% and 7% respectively.

The settlement price of Brent crude oil futures for August expiration on Monday fell 0.2% to $67.61 a barrel. September futures, which had relatively active trading, closed at $66.74. U.S. crude oil futures closed down 0.6%, with a settlement price of $65.11 per barrel.

On June 13, Israel launched a strike against Iran's nuclear facilities, triggering a 12-day war, causing oil prices to rise above $80 per barrel, and then fell back to $67.

John Kilduff, partner at AgainCapital, said: "The rapid ceasefire appears to be maintaining, so the existing supply risk premium is continuing to fall rapidly."

The Oil Supply Monthly Data released by the U.S. Energy Information Administration (EIA) showed that U.S. crude oil production reached a record 13.47 million barrels per day in April, up from 13.45 million barrels per day in March.

Kilduff added that record U.S. oil production exacerbated bearish sentiment on Monday. Four OPEC+ sources told Reuters last week that the league will increase production by 411,000 barrels per day in August after the increase in production in May, June and July. OPEC+ is scheduled to hold a meeting on July 6.

Saxo Bank Bulk"I think this potential supply pressure is still underestimated, making crude oil prices more prone to weakening," said Ole Hansen, head of www.xmh100.commodity strategy. The dollar fell to its lowest level against the euro on Monday, with investors worried about rising U.S. government deficits and uncertainty in trade deals with major countries.

U.S. Senate Republicans will work to pass President Trump's www.xmh100.comprehensive tax cuts and spending bill, despite party disagreements over the bill that is expected to increase national debt by $3.3 trillion.

The US dollar fell 0.63% against the Swiss franc to 0.79355 Swiss francs, down 3.60% in June. The dollar has fallen by about 12.5% against the Swiss franc this year.

The euro hit a high of $1.1780 against the dollar earlier since September 2021, with New York rising 0.45% at the end of the trading day and about 3.8% in June. The euro has risen about 14% against the dollar so far this year.

Amo Sahota, executive director of foreign exchange consulting firm KlarityFX, said, "Everyone is very concerned about this large-scale, huge bill and whether it can be passed, and the dollar has been on a weak trend. It is halfway through this year, with the biggest winners being the Swedish kroner, Swiss franc and the euro. The fate of the euro zone has reversed after an announcement of a huge spending bill."

According to Bloomberg News on Monday, the EU is willing to reach a trade agreement with the United States to impose a 10% universal tariff on its multiple exports, but is seeking the United States' www.xmh100.commitment to lower tariffs in key areas such as medicines, alcohol, semiconductors and www.xmh100.commercial aircraft.

U.S. Treasury Secretary Bescent warned on Monday that even if countries negotiate in good faith, he may still face a significant increase in tariffs on July 9, adding that any possible extension will be decided by President Trump.

Moneycorp North American structural director Eugene Epstein said, "The dollar weakens due to the potential for a substantial increase in the U.S. budget deficit, and uncertainty surrounding these tariff agreements continues," said Trump. "There are trade letters that Japan and other countries will receive trade letters that state the tariffs that need to be paid to the U.S.."

The US dollar fell 0.36% against the yen to 144.45 yen, and remained flat in June. To advance trade talks with Washington, Canada suspended plans to impose a new digital service tax on U.S. technology www.xmh100.companies just hours before the new tax took effect on Monday.

The Canadian dollar rose 0.41% against the dollar on Monday to 1.353 Canadian dollars, rising for the fifth straight month in June. The U.S. dollar index fell 0.35% to 96.86, falling for the sixth straight month in June and its worst first-half performance since the 1970s.

The Swedish Krona rose 0.48% against the US dollar to 9.462. The pound rose 0.04% against the dollar to $1.3719, up 2% in June.

International News

US Secretary of Agriculture: Trump may impose tariff exemptions on agricultural products that are not easy to grow in the United States

U.S. Secretary of Agriculture Brooke Rollins said that the Trump administration may consider imposing tariff exemptions on goods that are difficult to grow in the United States (such as cocoa beans or coffee). Currently, these goods are included in the scope of www.xmh100.comprehensive tariffs, and Democrats attack Republicans to raise costs.

Federal Bostic: The Fed will still be expected to lower interest rates once this year

Federal Bostic reiterated on Monday that he still expects the Fed to lower interest rates once this year, and pointed out that the Fed still has time to consider the latest data before deciding to take action. Bostic said he expects a rate cut in 2025, "My position is still there", noting that he expects three rates next year. "I think we are actually patient to keep interest rates unchanged for the time being, because the labor market is actually quite stable."

Inflation unexpectedly cooled down in June in Germany to reach the European Central Bank target for the first time in nearly a year

The German Federal Statistics Office said on Monday that consumer prices rose 2% year-on-year in June, down from the 2.1% increase in May. Economists had expected inflation to accelerate slightly to 2.2% in June. For the eurozone's largest economies, the June data showed a mixed situation. Although inflation in France and Spain rose slightly, Italy remained stable. The data are unlikely to prompt ECB officials to change their view that inflation targets are expected to continue to be met this year. Overall inflation data for the 20 countries in the euro zone will be released on Tuesday, with analysts expecting 2%, slightly higher than 1.9% in May. The next meeting of the European Central Bank will be held in July and is expected to suspend interest rate cuts. Since June 2024, the ECB has lowered deposit rates eight times, currently at 2%.

Media: Japan will start mining deep-sea rare earths next year

According to media reports, Japan will extract rare earth minerals from offshore deposits in a pioneering pilot project starting from January next year. It is reported that Japan's marine research and development agency will deploy the deep-sea scientific drilling vessel "Earth" 100 to 150 kilometers away from the coast of Minamito Island, which is a coral atoll about 1,950 kilometers southeast of Tokyo. A pipe will be sunk to the seabed 5,500 meters below the sea surface and collect 35 tons of soil. If successful, it would be the first ship operation in the world to recover rare earths from such depths.

84 provinces in France issued a heat wave orange warning nuclear power plant was suspended

The French Meteorological Bureau said on the 30th that the highest temperature in three quarters of the country exceeded 35 degrees Celsius on that day, and the temperature in some areas was as high as 40 degrees Celsius. 84 provinces have issued a heat wave orange warning. According to the French Meteorological Agency, this round of heat wave has swept across France since June 19 and is still continuing. July 1 will be the hottest day in this round of heat waves, with the highest temperature expected to reach 36 to 40 degrees Celsius, and some areas may reach 41 degrees Celsius, and there will be 16 provinces.Release a red alert for heat waves. Local media said that France has taken measures such as shutting down nuclear reactors, school holidays, and implementing flexible working hours on construction sites to cope with heat waves. French Electric Power www.xmh100.company confirmed on the 30th that it temporarily closed the Gorfish nuclear power plant in the south on the evening of the 29th to prevent the water of the Garonne River, which is the source of reactor cooling water, from overheating.

Japan's tax revenue in 2024 reached a new high for five consecutive years

It is reported that Japan's general tax revenue in 2024 was about 75.2 trillion yen, setting a record high for five consecutive years. It is about 1.8 trillion yen higher than the expected amount (73.43 trillion yen). Strong corporate performance has driven the growth of corporate tax, and consumption tax has also increased against the backdrop of expanded consumption and rising prices. The effect of wage increases has enabled income tax to maintain stable growth.

Netanyahu is reportedly visiting the White House to meet with Trump on July 7

According to Israeli and U.S. officials, Israeli Prime Minister Netanyahu is expected to meet with U.S. President Trump at the White House on July 7. Now the Trump administration is urging Israel to end the Gaza war and ensure that Hamas releases the remaining hostages seized. The officials asked for anonymity because of discussions on undisclosed information. The White House said earlier on Monday that it was studying the date of talks.

Turkish President: Ankara will host the 2026 NATO Summit

Turkish President Erdogan announced on the 30th that Ankara, the capital of Turkey, will host the 2026 NATO Summit. Erdogan said at a press conference after the cabinet meeting that day that the 2026 NATO summit will be held in Ankara in July 2026, and Türkiye will host NATO member leaders. Erdogan also introduced his attendance at this year's NATO summit at the press conference. He said Türkiye called for lifting restrictions on trade in defense industrial products within the framework of the NATO alliance. Türkiye joined NATO in 1952. Turkey connects Europe and the Middle East, is an important economy in the region, and has an important impact on the stability of Southeast Europe and the Middle East.

Domestic News

2025 World Humanoid Robot Games will be held in August at the National Speed Skating Hall "Ice Ribbon"

2025 World Humanoid Robot Games will be staged in the National Speed Skating Hall "Ice Ribbon" in mid-August. The news that robots will participate in track and field, football, martial arts, free gymnastics and other events will be full of expectations. It is understood that as of now, robot teams from the United States, Brazil, Germany, the Netherlands, Italy, Portugal, Japan, Singapore, Australia, the United Arab Emirates, Indonesia and other countries have www.xmh100.completed pre-registration for this event.

The State Administration of Foreign Exchange issued a new batch of QDII quotas totaling US$3.08 billion

It was learned from the State Administration of Foreign Exchange that the State Administration of Foreign Exchange has recently issued a total of US$3.08 billion to some qualified domestic institutional investors (QDIIs), aiming to further support QDII institutions to carry out cross-border investment business in accordance with the law.On the premise of effectively preventing risks, meet the reasonable foreign investment needs of domestic residents in an orderly manner.

The above content is all about "[XM Foreign Exchange Market Analysis]: Trump may impose tariff exemptions on agricultural products, waiting for US economic data, gold prices are helped by the weakening of the US dollar". It is carefully www.xmh100.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your transactions! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Decision Analysis】--USD/CHF Forecast: Can the US Dollar Find Momentum Agains

- 【XM Decision Analysis】--NASDAQ 100 Monthly Forecast: January 2025

- 【XM Market Review】--Nasdaq Forex Signal: Plunges After Better Jobs Figures

- 【XM Group】--GBP/USD Forecast: Struggles Against the Dollar

- 【XM Market Analysis】--BTC/USD Forecast: Bitcoin Holds $100K Support