Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

The US dollar index maintains low fluctuations, and the market welcomes "non-farm" data

Wonderful introduction:

Life needs a smile. When you meet friends and relatives, you can give them a smile, which can inspire people's hearts and enhance friendship. When you receive help from strangers, you will feel www.xmh100.comfortable with both parties; if you give yourself a smile, life will be better!

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: The US dollar index maintains a low fluctuation, and the market welcomes "non-agricultural" data". Hope it will be helpful to you! The original content is as follows:

On Thursday, the US dollar index maintained a narrow range of fluctuations, the US dollar rose against major currencies on Wednesday, data supported the market's expectations of the Federal Reserve's interest rate cut, and the pound fell due to the sell-off of British government bonds. Traders also adjusted positions before the U.S. Department of Labor released its June employment report and July 4 holiday on Thursday. The dollar fell earlier, but regained momentum after the ADP National Employment Report was released. The report shows that private jobs in the United States fell for the first time in more than two years in June, suggesting that the Fed may cut interest rates as early as September.

Analysis of major currencies

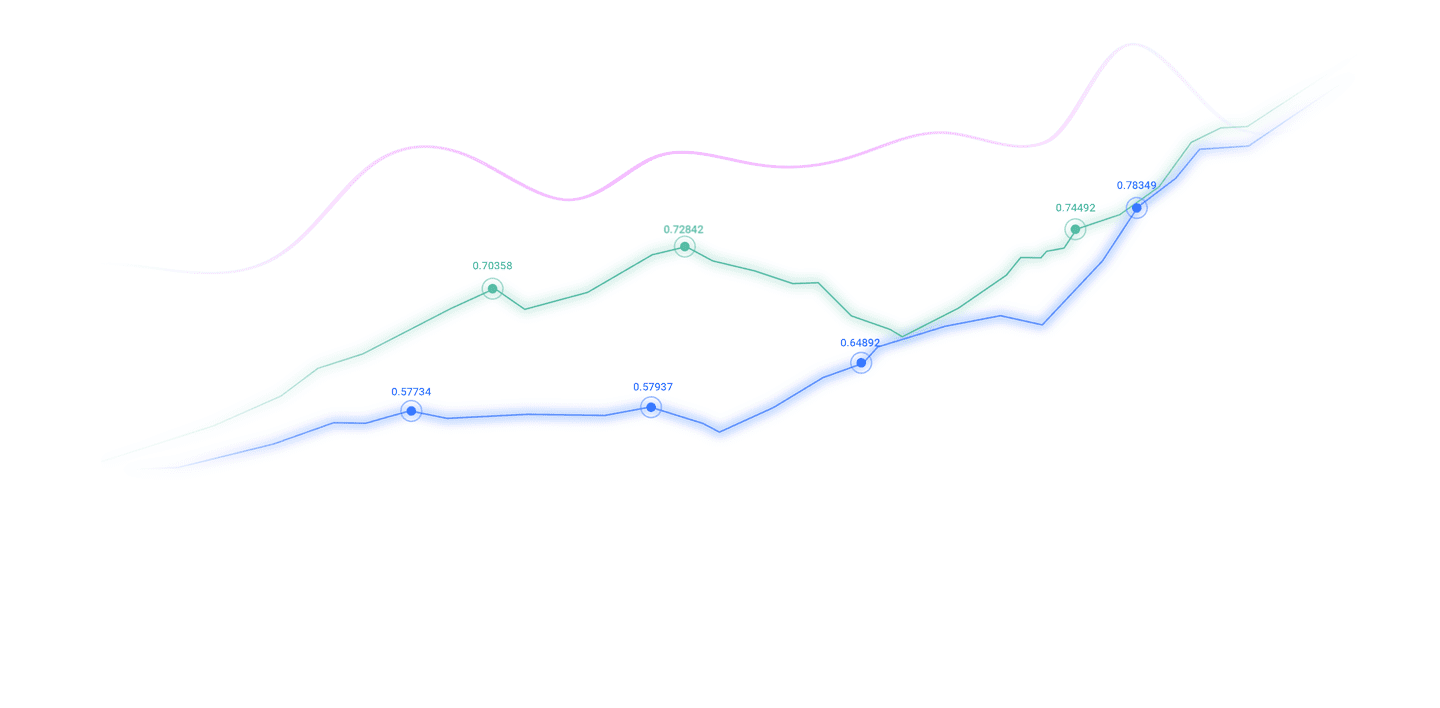

Dollar: As of press time, the U.S. dollar index hovers around 96.72, with the U.S. dollar (USD) trading on a slightly positive tone on Wednesday, rebounding slightly after hitting its lowest level since February 2022 on Tuesday. The mild rebound occurred after traders digested U.S. economic data and cautious www.xmh100.comments from Fed Chairman Jerome Powell, which slightly eased downward pressure on the dollar. However, concerns about tariffs, fiscal policy and the Fed's next move still put pressure on the overall outlook for the dollar. Technically, while the rebound looks encouraging, the price is still limited to below the 9-day exponential moving average (EMA), which is currently around 97.39. Recent price movements have slightly broken through the lower boundary of the downward wedge pattern—a structure that is usually associated with bullish reversal signals. If the daily closing is higher than the wedge resistance level and the above EMA, it may open the door for a stronger rebound, with the target range of 98.20-98.60.

1. Unexpected decline in employment in the private sector in the United States

U.S. Private enterprises in the United States experienced their first decline in employment in more than two years last month due to economic uncertainty. According to the National Employment Report released by ADP, the United States saw a total of 33,000 jobs cut in June, www.xmh100.compared with 29,000 jobs in May. This is the first time since March 2023 that the number of jobs has dropped. Economists surveyed by the Wall Street Journal previously expected that the number of new jobs would increase to 100,000 that month. "While layoffs are still rare, hiring hesitation and reluctance to replace resignations result in a decrease in employment last month," said Nela Richardson, chief economist at ADP. However, the slowdown has not yet affected annual www.xmh100.compensation growth, with an increase of 4.4% in June, just slightly lower than 4.5% in May.

2. IMF: Unless there is a new shock, the ECB should maintain interest rates at 2%.

Alfred Kammer, head of the IMF's European Department, said that the ECB should maintain deposit interest rates at the current level of 2%, except forNon-new shocks have substantially changed the inflation outlook. The ECB has cut interest rates by two percentage points since June 2024 and has hinted this month that it will suspend interest rate cuts, although financial investors still believe the bank will cut interest rates to 1.75% again later this year. “The risk of inflation in the euro zone is two-sided,” Kammer said. "That's why we think the ECB should stick with it and not deviate from the 2% deposit rate unless there is a shock that substantially changes the inflation outlook." "We haven't seen such a big change yet." Part of the reason why the IMF differs from the market is that the IMF expects inflation levels to be higher than the ECB's expectations next year.

3. ECB Regulatory www.xmh100.commission Renne: European joint defense borrowing can enhance the global status of the euro

ECB Regulatory www.xmh100.commission Renne said that Europe should concentrate defense investment because it will reduce costs, speed up the process, and create a new security financial asset, thereby enhancing the international status of the euro. European Central Bank President Lagarde has said that the unstable U.S. economic policies have created room for the euro to seize market share from the dollar on the global stage, but this requires the eurozone to restart a long-standing stagnant process to www.xmh100.complete its financial structure. Joint defense borrowing can boost the prospects of Europe and the euro in two ways: it will create a large-scale, liquid security asset that is necessary for the smooth operation of the financial sector; it will also improve defense capabilities, which is a must for any group that issues major reserve currencies.

4. The Bank of Korea is expected to postpone the next rate cut to October

MinJoo Kang, senior economist at Dutch International Group, said that the Bank of Korea is expected to postpone the next rate cut to October in response to the recent rise in domestic housing prices and household debt. Kang pointed out that the Bank of Korea can act cautiously and focus more on financial stability, and inflation is expected to be near the central bank's 2% target for the foreseeable future. Overall consumer inflation in the country rose 2.2% year-on-year in June, slightly higher than the market's general expectations of 2.1%. Excluding volatile food and energy prices, the core inflation rate has stabilized at 2.0% for the second consecutive month.

5. "Federal Mickey Bucket": Powell maintains flexibility. The decision-making factors for interest rate cuts have changed.

"Federal Mickey Bucket" Nick Timiraos said that Powell avoided a sharp issue in July (rate cuts) and refused to rule out any possibility four weeks before the policy meeting. His overall www.xmh100.comments have little indication that he is preparing for the rate cut this month. It is inappropriate to focus on July’s “over” (at least today) and it may mask the more subtle changes in his and others’ remarks in recent weeks. After the Liberation Day tariffs, there is a speculation that price increases may be so large that a substantial weakness in the labor market is required to cut interest rates. But recently, with the suspension of tariffs and early (maybe premature?) inflation readings have not shown meaningful effects, Powell suggests that if inflation is not worried about thatHow bad it may resume interest rate cuts.

Institutional View

1. Becente: The Federal Reserve may cut interest rates in September or earlier

U.S. Treasury Secretary Becente said Tuesday night that he believes the Federal Reserve may cut interest rates in September or "early" because so far, Trump's tariffs have only triggered moderate inflation. "I think the standard is that tariffs don't cause inflation. If they were to follow this standard, I think they might take action earlier, but it will certainly be by September," Becent said. "I guess this tariff disorder syndrome will even happen in the Fed." Becent's www.xmh100.comments came as Trump increased pressure on the Fed and Powell to lower interest rates to up to 3 percentage points.

2. Capita Macro: U.S. Treasury bonds may face challenges for the rest of the year

Capita Macro analyst Thomas Mathews said in a report that despite strong performance in the recent past, it is expected to be difficult for the rest of the year. “The weeks-long rally in U.S. Treasury bonds appear to have been suspended,” Mathews said. The remarks made by Fed Chairman Powell at a meeting in Sintra, Portugal appear to be a factor in the suspension of the rally. Powell said that as long as the economy is stable, there will be no rush to cut interest rates. "In our case, we doubt whether the Fed will get the evidence needed to cut interest rates by next year, and whether it will succumb to political pressure," he said. Capita Macro expects the Fed to cut interest rates by next year.

The above content is all about "[XM Foreign Exchange Decision Analysis]: The US dollar index maintains a low fluctuation, and the market welcomes "non-agricultural" data". It is carefully www.xmh100.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Forex】--AUD/USD Forex Signal: Neutral Consolidation Within Bearish Price Cha

- 【XM Forex】--Silver Forecast: Silver Attempting to Find a Foothold

- 【XM Decision Analysis】--Gold Analysis: Awaiting Key Events

- 【XM Market Analysis】--BTC/USD Forex Signal: Bitcoin Analysis as Doji, Wedge Form

- 【XM Group】--USD/JPY Forex Signal: Surges as Rate Gap Favors Dollar