Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Chinese live lecture today's preview

- Trump announces about 100% tariffs on chips, U.S., Russia and Ukraine leaders ho

- The US dollar hovers at 147 mark against the yen, and the market is waiting for

- The United States may see recession signals, but the euro zone secretly "recover

- When will gold fluctuate?

market analysis

Putt will not reach a key agreement! The U.S. inflation signal conflicts, with as many as 11 candidates for the head of the Federal Reserve

Wonderful introduction:

Since ancient times, there have been joys and sorrows, and since ancient times, there have been sorrowful moon and songs. But we never understood it, and we thought everything was just a distant memory. Because there is no real experience, there is no deep feeling in the heart.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: Puter has not reached a key agreement! The US inflation signal is inconsistent, and there are as many as 11 candidates for the head of the Federal Reserve." Hope it will be helpful to you! The original content is as follows:

The US economic data over the past week have mixed emotions, resulting in continued fluctuations in market expectations for the Fed's interest rate cut. Data released on Friday showed widespread growth in retail sales in the U.S., driven by car sales and large online promotions. Another report released later showed that consumer confidence fell unexpectedly, for the first time since April, and inflation expectations rose.

Previously, the US CPI and PPI reports in July seemed to send different signals in indicating whether the economy was resistant to the impact of Trump's www.xmh100.comprehensive import tariffs, but both showed that service inflation was stubborn, with PPI hitting a three-year high month-on-month. At the same time, there are obvious differences within the Federal Reserve on the September rate cut.

U.S. stocks fell from historical highs on Friday, and chip stocks fell generally due to Trump's latest tariff threat; medical insurance giant United Health rose sharply after being increased by Buffett, pushing the Dow Jones Industrial Average to a record high, while the S&P 500 and Nasdaq fell.

As the outside world continues to speculate about the Fed restarting interest rate cuts, the US dollar index closed down for the second consecutive week, falling back to the area below 98. U.S. Treasury yields generally rose amid inflation concerns, with long-term yields leading the rise, and 10-year U.S. Treasury yields hit a two-week high.

The first face-to-face meeting between the U.S. and Russia heads of state in four years also made the market hold their breath. Investors are concerned about whether the "Tepco" has the potential to eliminate signs of a major geopolitical crisis. Crude oil prices closed lower on Friday, with two consecutive negative weekly lines. Gold remained flat on Friday, but suffered a sharp drop earlier this week as Trump clarified that no gold tariffs would be imposed.

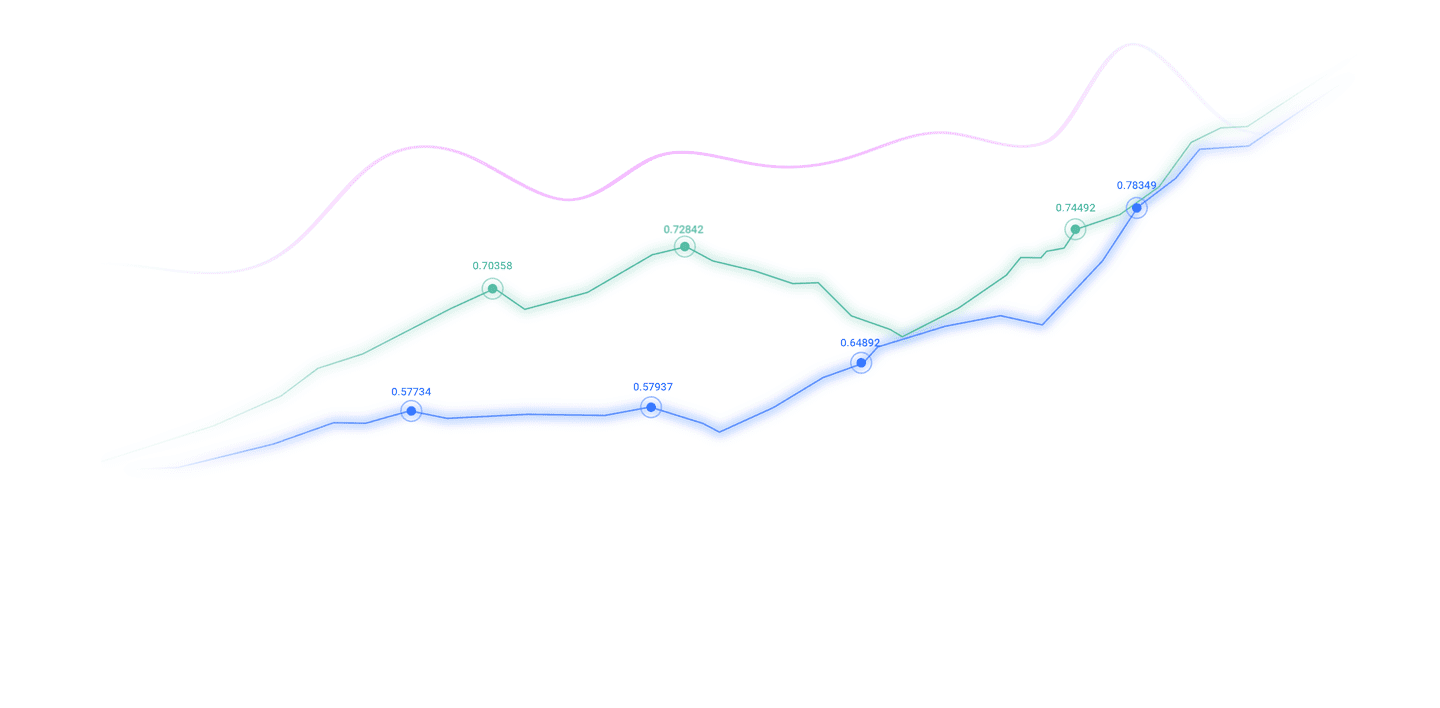

Forex Market:The US dollar index lacks a clear trend this week. On Tuesday, U.S. CPI inflation rose only moderately in July, 9Expectations of monthly interest rate cuts have heated up, and the US dollar index began to continue to fall and fell below the 98 mark. Subsequently, due to higher than expected PPI in July, which may suggest a rebound in future inflation, the US dollar index once returned to above the 98 mark, but closed at 97.82 below it on Friday, closing lower for the second consecutive week. In terms of non-US currencies, the euro and pound pound recorded a gain against the dollar for the second consecutive week. The dollar declined slightly against the yen this week, and the market expects the Bank of Japan to deal with inflation or consider interest rate hikes, which also provides support for the yen.

Gold Market:Spot gold recorded a decline overall, closing at $3335.73 per ounce, a drop of 1.8%. On Monday, gold prices fell nearly $60 to around $3,340 during the day as Trump said he would not impose tariffs on imported gold bars, and the market then entered a consolidation. The weakness of the dollar and geopolitical uncertainty still provided some support for gold.

Crude oil market: In terms of international oil prices, as the IEA issued pessimistic supply guidelines, Trump threatened Putin before the Putin, and oil prices hit a new low for more than two months, and then rebounded to near the weekly high on Thursday, but the two oils still closed for the second consecutive week.

This week, OPEC raised its oil demand forecast for next year and lowered its supply growth forecast for non-OPEC+ oil-producing countries; the U.S. Energy Information Administration lowered its oil price expectations this year and next two years. The IEA, on the other hand, lowered its forecast for global oil demand growth this year and next year, and expects a record surplus in global oil supply next year.

A Review of Weekly News 1. Inflation data boosts the expectation of a rate cut in September. Trump nominates critics to take charge of BLS. The US July CPI data released on Tuesday showed that inflation pressure is relatively moderate, driving the market's expectations for the Fed's interest rate cut in September rose sharply, with the probability as high as 95%. Data shows that the overall CPI rose by 0.2% month-on-month, in line with expectations, up 2.7% year-on-year, lower than the expected 2.8%. After excluding food and energy, the core CPI rose 0.3% month-on-month and 3.1% year-on-year, setting a new high since February. It was mainly driven by the rise in prices in the service industries such as housing, health care, and airfare prices, while a few sub-indexes such as hotel accommodation and www.xmh100.communications fell. However, the US July PPI announced on Thursday rose by 0.9% month-on-month, far exceeding expectations, with a year-on-year growth rate of 3.3%, indicating that inflation pressure still exists. Service inflation is the main driving factor, among which the rise in trade services profit margins are related to tariff policies. Traders have re-reduced bets on the Fed's interest rate cut in September after economic data were released. Friday's retail sales data were in line with expectations, and traders still expected a rate cut in September and another rate cut in 2025. This week, Trump announced that he would nominate E.J. Anthony, an economist at the conservative think tank Heritage Foundation, as director of the Bureau of Labor Statistics. Anthony is the chief economist at the Heritage Foundation’s Federal Budget Center, which has long supported Trump’s policies and has been involved in developing itsThe conservative agenda for the second term. The nomination requires Senate approval, but there is little resistance expected to be expected when Republicans are the majority. Anthony has repeatedly criticized the data released by the Bureau of Labor Statistics, proposing that the release of monthly non-farm employment reports should be suspended before revising data collection issues, and only quarterly data should be released, citing that the monthly reports are unreliable and often exaggerated, affecting corporate decision-making and the implementation of Federal Reserve policies. However, White House officials said Anthony's remarks do not represent official policy. White House staff and Labor Department officials are weighing new options and techniques for data collection, aiming to increase response rates for the Bureau of Labor Statistics survey. Trump expressed dissatisfaction with the sharp correction of employment data, believing that it weakened his assertion that “the economy takes off in its second term.” White House Press Secretary Caroline Levitt said the U.S. president is examining the "methods and means" of employment data. 3. Trump stepped up his search for Powell's successor, and interest rate differences within the Federal Reserve intensified. Trump said he may announce the nomination for the next Federal Reserve Chairman "slightly ahead of schedule" and revealed that the candidates have been reduced to three to four, all of which are "excellent and outstanding" candidates. However, Treasury Secretary Bescent revealed that the government may consider as many as eleven people. The new list includes BlackRock Group's global fixed income chief investment officer Rick Rieder, Jefferies Group's chief market strategist David Zervos, former Federal Reserve director and Bush administration official Larry Lindsey, Fed governor Bowman and Jefferson, Dallas Fed chairman Logan, White House economist Hassett, former Federal Reserve director Wash, former Bush administration official Marc Sumerlin and former St. Louis Fed chairman Brad. Trump called for a rate cut on social media again this week and criticized Fed Chairman Powell as "Mr. Too Chi", accusing his policy of lagging and causing economic damage, and even considering filing a major lawsuit against Powell on the grounds of improper management of the Fed's construction project. In terms of policy stance, Trump's new Fed director Milan and Brad, who is new to the Fed's chairman, both said tariffs will not trigger inflation and support interest rate cuts. Brad expects the Federal Reserve to start cutting interest rates in September, with a cumulative interest rate cut of one percentage point to a neutral level in the next year; Milan declined to www.xmh100.comment in detail, saying that the nomination proposal is about to enter the Senate confirmation process, and he advocated reform of the Federal Reserve's governance structure last year. Treasury Secretary Bescent repeatedly publicly called for a 50 basis point rate cut this week, saying that the revised data indicates weak employment growth. If the Fed had known of these data, the Fed would have cut interest rates in advance. He predicted interest rates should be cut by 150 to 175 basis points and said he would retain gold reserves and would not be likely to reassess positions while stopping selling Bitcoin reserves worth about $15 billion to $20 billion. At the same timeThere were voices within the Federal Reserve opposing large and rapid rate cuts. Atlanta Fed Chairman Bostic believes that if the labor market remains stable, only one rate cut in 2025 can be cut; Chicago Fed Chairman Goulsby warned of great uncertainty in this fall policy meeting and expressed concerns about rising service inflation; San Francisco Fed Chairman Daley opposes a 50 basis point interest rate cut in September, supports a slight rate cut and gradually adjusts the policy within a year, believing that two interest rate cuts this year are more appropriate. Next week, Powell is expected to set the tone for the September monetary policy meeting. He will speak at the annual central bank meeting in Jackson Hole, Wyoming at 10 p.m. Beijing time on August 22. 3. Goldman Sachs withstand Trump's bombardment: Two-thirds of the cost of tariffs may be passed on to consumers Goldman Sachs economist Merrick insists on forecasting that the cost of tariffs will begin to impact consumer wallets. Previously, Trump criticized Goldman Sachs on social platform TruthSocial, hinting that its CEO Solomon should "change an economist" or consider resigning, saying that he should be a DJ. Merrick responded that despite the president's opposition, Goldman Sachs remained confident in the research results. The forecast is based on a report released by Goldman Sachs economist Peng Aisi. The report notes that while exporters and businesses have absorbed most of the tariff costs so far, the burden will turn to consumers in the www.xmh100.coming months. Goldman Sachs model shows that consumers will eventually bear about two-thirds of the total cost. If the forecast www.xmh100.comes true, by the end of the year, the core PCE price index of the Federal Reserve's focus will rise to 3.2%, www.xmh100.compared with 2.8% in June, with the Fed's inflation target of 2%. Merrick explained that tariff-protected American manufacturers have room to increase prices to make profits, which is consistent with the conclusions of other economists. He also said Trump could still get some of the rate cuts he demanded that the Fed implement. The impact of tariffs has not yet been fully revealed and is a one-time price level effect, which is not enough to significantly affect Fed decisions because it is currently more focused on the labor market. The above content is all about "[XM Foreign Exchange Market Analysis]: Puter has not reached a key agreement! The US inflation signal is inconsistent, and the Federal Reserve has selected up to 11 people" and is carefully www.xmh100.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your transactions! Thanks for the support! Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here