Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Canada's CPI is expected to soar month-on-month in July, and CPI data triggered

- Increased supply of OPEC+ drags oil prices down by nearly 2%, Fed rate cut expec

- OPEC+ increased production, crude oil prices fell to around the 50-day moving av

- The battle between eagles and pigeons has not yet ended. Is it a blessing or a d

- Powell's hawkish statements cannot hide the dovish turn. Will September repeat t

market analysis

The US yield curve steeply sounds the inflation alarm, but Europe has a chance to make arbitrage

Wonderful introduction:

Don't learn to be sad in the years of youth, what www.xmh100.comes and goes cannot withstand the passing time. What I promise you may not be the end of the world. Do you remember that the ice blue that has not been asleep in the night is like the romance swallowed by purple jasmine, but the road is far away and people have not returned, where can the love be lost?

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: The US yield curve steeply sounds the inflation alarm, but Europe has a good opportunity to make arbitrage." Hope it will be helpful to you! The original content is as follows:

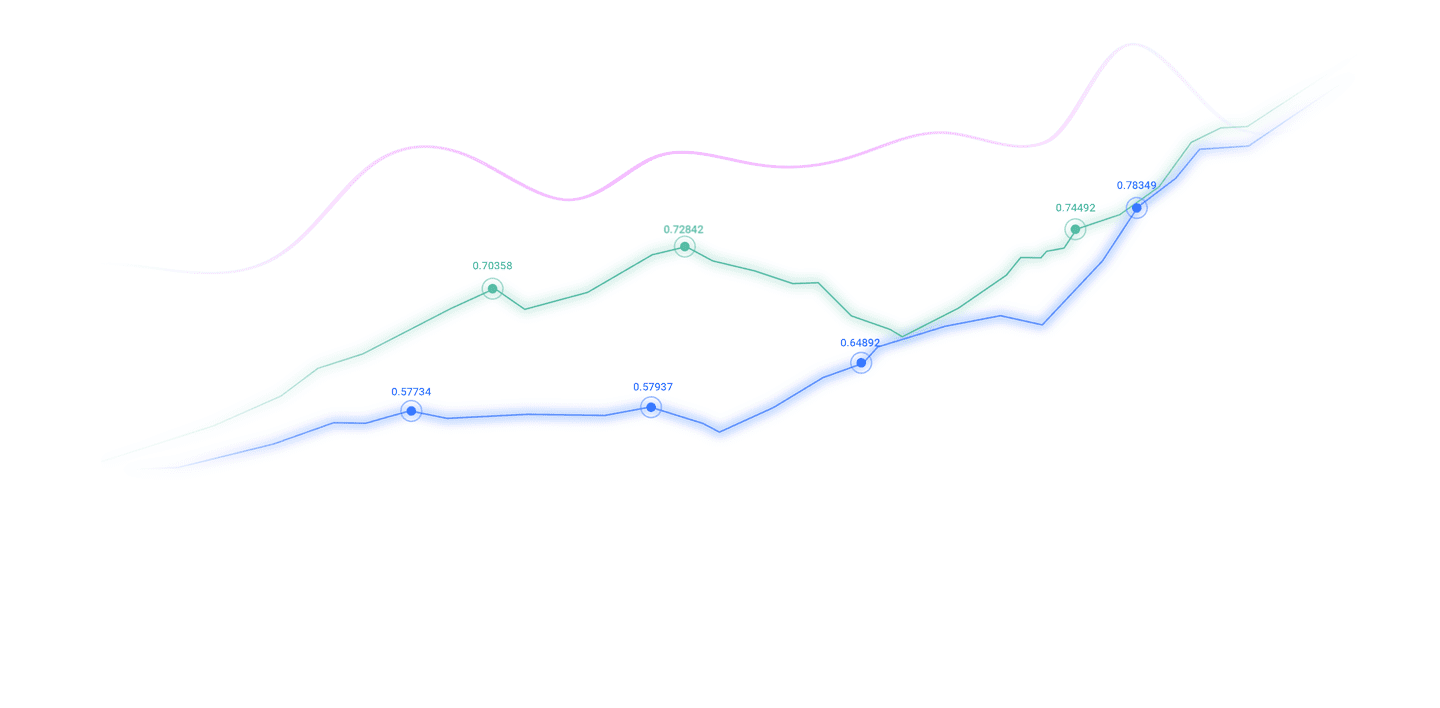

XM Foreign Exchange APP News-On Friday (August 15) during the Asian session, the euro-USD trend rose 0.05% at 1.1653. On Thursday night, affected by the US PPI index exceeding expectations and the euro short-end long-end interest rate swap (ESTR) curve hit a new high, the euro closed down 0.5% against the US dollar. The upcoming pension reform in the Netherlands has played an important role in the steepening of the swap curve, and this impact will continue in the future. At the same time, the steep interest rate spread curve in the United States lies in concerns about inflation, while the steepness in Europe lies in the arbitrage trading of traders and the selling of short-term European far-term treasury bonds brought about by the Dutch pension reform. Therefore, the steep reason for the short-term and long-term treasury bond spread curve in Europe is different from that in the United States. The U.S. Producer Price Index (PPI) unexpectedly rose 3.7% year-on-year, with the only reaction in the bond market - the U.S. Treasury yield rebounded. At first, the market response was not very strong, with only a slight increase of single-digit percentage points on the entire yield curve. It seems that the market believes that "this is just PPI data." If the Consumer Price Index (CPI) experiences such an increase, the market will be much more intense—especially the data of PPI rising by 0.9% month-on-month in July. Despite this, within the hours after the data was released, the market was under obvious pressure, and the overall reaction was quite significant: the yield on the 10-year treasury bond rose by nearly 10 basis points, and the yield on the 2-year treasury bond also rose sharply, but the amplitude was slightly smaller, which made the 2/10-year treasury bond spread curve steeper. In addition, the number of people applying for unemployment benefits for the first time has stabilized at around 225,000, which has also boosted the rate of return. James Knightley, chief international economist at Dutch International, pointed out thatFive (August 15) will be a test worthy of attention. At present, the overall import price is negative year-on-year, but this is due to the decline in energy prices. Core import prices can better reflect whether foreign www.xmh100.companies are adjusting their pricing. Since the announcement of the tariff policy, import prices in April have risen by 0.3% month-on-month, and remained the same in May and June. Import prices are expected to rise again in July. Recently, the ultra-long end volatility of the euro swap curve has risen (it can be roughly understood as a treasury yield curve without national credit risk exposure), and we believe that subsequent volatility may further intensify. The overall volatility indicator of euro interest rates is gradually downward, but the implicit volatility of the 30-year interest rate in the next three months has been against the trend and has risen again this month. The recent rise in 30-year interest rates is not simply due to fiscal concerns. The upcoming Dutch pension transformation may be an important driving force. If the increase in government bond issuance is the core driver, then the performance of German Treasury bond yields should be weaker than swap rates (i.e., the increase in Treasury bond yields exceeds swap rates). The U.S. market is showing this characteristic - the fiscal deficit has caused investors' concerns, but the euro zone's 30-year swap spread (the difference between Treasury yield and swap rate) has remained relatively stable in recent months. Therefore, we believe that the market expects the Dutch pension fund to reduce its holdings in long-term swap contracts, which may be a potential driver of the recent market. As many large Dutch pension funds prepare for the transformation on January 1, 2026, the 10-year and 30-year swap curve may steeper further. The interest rate spread has hit a new high since 2021, and it is difficult to find the reverse driver in the short term. From a longer cycle, curve flattening is usually triggered by the start of the interest rate hike cycle. However, the current inflation outlook is more dominated by downside risks, and it is difficult to see market narratives related to interest rate hikes in the short term. Market trends and opinions on Friday US economic data continues to affect the current market environment. Judging from the data to be released on Friday, this trend is likely to continue. Following the rise in the Producer Price Index (PPI), the market will closely monitor the release of import price data. Other key data include retail sales, industrial output, and the University of Michigan Consumer Confidence Index. In terms of retail sales, core retail sales are expected to increase by 0.4% month-on-month in July. The consumer confidence index is expected to remain stable or slightly higher. One-year consumer inflation expectations are expected to fall slightly to 4.4%, but this level is still high. Given the high sensitivity of investors to U.S. Treasury demand, the market will also pay attention to the June International Capital Current Report (TIC) data. The steep US yield curve is caused by inflation concerns, and the steep European curve is caused by Dutch pension reform and trader arbitrage. Therefore, the steep short-term long-term interest rate spread in Europe should not be considered inflation concerns in the short term, which puts pressure on the euro, but is a trading opportunity for euro long and bond arbitrage. (Euro-USD daily chart, source: Yihuitong) 9:48 Beijing time, the euro-USD is currently at 1.1657/58.

The above content is all about "[XM Foreign Exchange Market Analysis]: The US yield curve steeply sounds the inflation alarm, but Europe has a good opportunity to make arbitrage."It was carefully www.xmh100.compiled and edited by the XM Forex editor. I hope it will be helpful to your transactions! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here