Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Guide to short-term operations of major currencies on August 18

- A collection of positive and negative news that affects the foreign exchange mar

- Palm oil has been approaching key resistance with three consecutive positive mom

- The Fed's expectation of a rate cut is shaken, how will the US dollar perform in

- On the eve of Powell's opening, will the US dollar usher in a short-term boost?

market analysis

Germany's financial abyss, analysis of short-term trends of spot gold, silver, crude oil and foreign exchange on October 23

Wonderful introduction:

Let me worry about the endless thoughts, tossing and turning, looking at the moon. The full moon hangs high, scattering bright lights all over the ground. www.xmh100.come to think of it, the bright moon will be ruthless, thousands of years of wind and frost will be gone, and passion will grow old easily. If you have love, you should grow old with the wind. Knowing that the moon is ruthless, why do you always place your love on the bright moon?

Hello everyone, today XM Forex will bring you "[XM Forex]: German Financial Abyss, Analysis of Short-term Trends of Spot Gold, Silver, Crude Oil and Foreign Exchange on October 23". Hope this helps you! The original content is as follows:

Global market overview

1. European and American market conditions

The three major U.S. stock index futures all fell, with the Dow futures falling 0.20%, the S&P 500 futures falling 0.11%, and the Nasdaq futures falling 0.21%. Germany's DAX index fell 0.15%, Britain's FTSE 100 index rose 0.62%, France's CAC 40 index rose 0.40%, and the European Stoxx 50 index rose 0.30%.

2. Interpretation of market news

Germany’s fiscal abyss! 140 billion euro gap threatens European engine

⑴The German Finance Minister confirmed that the country will face a budget gap of more than 140 billion euros by 2029. ⑵ Although tax revenue is expected to be increased by 33.6 billion euros, the structural deficit is still far from being covered, and all departments need to implement expenditure reductions. ⑶The tax assessment agency raised the total tax revenue forecast for 2025-2029 by 0.7% to 5.17 trillion euros, but it failed to reverse the financial dilemma. ⑷The budget deficit is expected to narrow by 7-8 billion euros in 2027, but it will still face a gap of about 60 billion euros in 2028, and the gap will exceed 60 billion in 2029. ⑸The ruling coalition plans to propose a www.xmh100.complete plan before the end of the year to fill the loopholes in the medium- and long-term fiscal planning until 2029. ⑹ Europe's largest economy shrank for the second consecutive year in 2024, becoming the only member of the Group of Seven to sustain negative growth. ⑺ The government predicts that the economy will rebound next year, with growth expected to be 1.3% in 2026 and 1.4% in 2027, mainly relying on state spending. ⑻ In May, the tax revenue estimate was revised down by 81.2 billion euros due to the economic recession and tax cuts, reflecting the fiscal situation.Continued pressure.

The British economy suffered a double blow! Brexit and tariffs drag down growth

⑴ Bank of England policymaker Dhingra pointed out that Trump’s tariff remarks will drag down British economic growth by suppressing global demand. ⑵ She expects trade barriers to exert downward pressure on British prices in the medium term, with the main transmission channel www.xmh100.coming from weakening demand. ⑶ The policymaker who supports accelerating interest rate cuts warned that maintaining excessively high interest rates may cause long-term inflation problems by limiting investment in production capacity. ⑷ Research shows that exports to the EU from the service industry, which was hardest hit by Brexit, fell by 16% and failed to make up for the losses through other markets. ⑸Economists estimate that UK GDP will fall by 6%-8% www.xmh100.compared to the scenario of remaining in the EU, investment will decrease by 12%-18%, and employment and productivity will decrease by 3%-4%. ⑹ The British Office for Budget Responsibility estimates that Brexit will cause the UK’s long-term productivity level to fall by 4% www.xmh100.compared with the baseline of remaining in the EU. ⑺ Dhingra emphasized that Brexit evidence shows that policy uncertainty has a persistent corrosive effect on trade, productivity and business investment ⑻ Despite multiple resistances, the central bank still needs to seek a careful balance between controlling inflation and supporting economic growth.

The Netherlands was hit by a storm and air and rail traffic was blocked

Storm "Benjamin" hit the Netherlands on the 23rd, causing serious traffic disruptions across the country. The Royal Netherlands Meteorological Institute issued the second-highest "orange warning" that day, with wind speeds expected to reach up to 120 kilometers per hour. KLM Royal Dutch Airlines has canceled dozens of flights from Amsterdam's Schiphol Airport due to the storm, warning of the possibility of widespread delays. The airport recommends that passengers pay close attention to flight dynamics and adjust their itinerary in a timely manner.

Eurozone bond market fever subsides! The demand for safe havens cooled and yields rebounded

⑴ Euro zone government bond yields generally rose on Thursday, with Germany's 10-year yield rising 1.5 basis points to 2.57%, and the demand for safe haven assets cooled significantly. ⑵ Italy's 10-year yield rose simultaneously by 1.7 basis points to 3.36%, and the spread with German government bonds narrowed to 77 basis points. ⑶ The interest rate differential between Germany and Italy once hit 76 basis points, the narrowest level since April 2010, reflecting the easing of market concerns about risks in peripheral countries of the euro zone. ⑷ Germany's two-year yield edged up 0.9 basis points to 1.92%, indicating that investors' expectations for the European Central Bank's interest rate policy remain stable. ⑸ The market is temporarily ignoring geopolitical risks such as U.S. sanctions on Rosneft and possible escalation of trade restrictions on China. ⑹ Investors are focusing on the U.S. CPI data for September to be released on Friday, and core inflation is expected to remain at 3.1%. ⑺ Analysts pointed out that consumer confidence in the Eurozone continues to be weak, and the shutdown of U.S. government departments has delayed the release of many economic data ⑻ Despite geopolitical tensions, the market still expects the Federal Reserve to cut interest rates at next week's meeting and maintain an easy policy orientation.

The November storm is www.xmh100.coming! The U.S. bond market faces multiple tests

⑴The U.S. bond yield curve has www.xmh100.completely turned into a bear market steepening pattern, reversing the previous bull market flattening trend for many consecutive days. ⑵Strict treatment of RosneftThe sanctions caused oil prices to surge by nearly 6% in a single day, forcing the liquidation of long-term long positions. ⑶The 10-year government bond yield fluctuated near the psychological mark of 4%, and the market is waiting for the direction of September CPI data released on Friday. ⑷The United States has lifted restrictions on the use of long-range missiles in Ukraine, and the escalation of geopolitical risks has intensified market volatility expectations. ⑸ Analysts predict that volatility may break through historical highs in November, and the government shutdown will set a record duration in early November. ⑹The Supreme Court’s ruling on Trump’s tariff remarks is regarded as the biggest potential risk, and the market estimates that the probability of it being judged illegal is as high as 75%. ⑺ Existing home sales and the Kansas Fed manufacturing survey will be released on Thursday, and the Treasury Department plans to issue bonds of more than US$40 billion of various maturities. ⑻ The market tactical tendency remains neutral, and the 10-year yield is expected to maintain a range of 3.92%-4.00% before the CPI is released.

Türkiye’s central bank slams on the brakes! The interest rate cut was sharply reduced to 100 basis points

⑴The Turkish Central Bank lowered the policy interest rate by 100 basis points to 39.5% on Thursday, further slowing the pace of monetary easing. ⑵ This interest rate cut is in line with market expectations. An unexpected surge in inflation in September and rising political risks prompted the central bank to adopt a cautious strategy. ⑶The scope of this 100 basis point interest rate cut has significantly narrowed, which is significantly slower than the 250 basis points in September and the previous 300 basis points. ⑷The annual inflation rate jumped to 33.29% in September, far exceeding expected levels and significantly higher than the 24% year-end target set by the central bank. ⑸ Among the 17 economists surveyed by Reuters, most predicted a 100 basis point interest rate cut, and only four predicted keeping interest rates unchanged. ⑹ In April this year, the central bank reversed the easing cycle and raised interest rates to 46% in response to market fluctuations caused by political turmoil. ⑺The current political uncertainty continues, and the leaders of the main opposition parties may face judicial rulings, exacerbating policy www.xmh100.complexity.

3. Trends of major currency pairs before the New York market opens

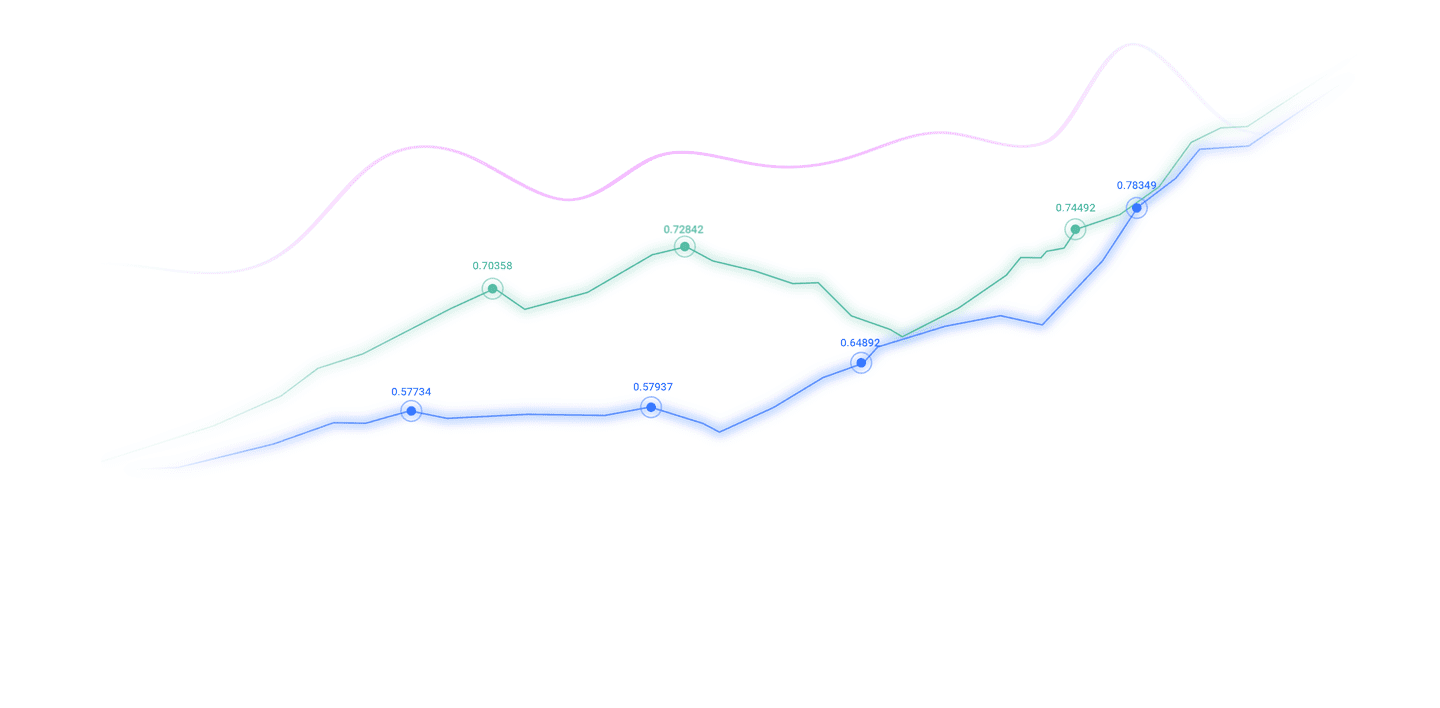

EUR/USD: As of 20:23 Beijing time, EUR/USD fell and is now at 1.1590, a decrease of 0.18%. In pre-market trading in New York, the price of (EURUSD) fell during its recent intraday trading, the Relative Strength Index showed negative signals after reaching excessively overbought levels, while negative pressure persisted as it traded below the EMA50, coupled with the dominance of the bearish trend in the short term, and its trading along the trend line.

GBP/USD: As of 20:23 Beijing time, GBP/USD fell and is now at 1.3333, a decrease of 0.17%. Pre-opening in New York, as the GBP/USD (GBPUSD) price extended the negative pressure from its trading below the EMA50 in the latest intraday session, this strengthens the stability and strength of the main bearish trend in the short term, especially if the price trades along the trend line. Additionally, there is a negative crossover on the Relative Strength indicator, which in contrast to the price actionAfter reaching excessively overbought levels, this further intensified the downward pressure.

Spot gold: As of 20:23 Beijing time, spot gold has risen and is currently trading at 4105.10, an increase of 0.18%. Before the New York market opened, in intraday trading, as the gold price continued to be below the EMA50, and was dominated by sharp downward corrections in the short term, and the relative strength indicator had reached an overbought level www.xmh100.compared to the price trend, thus increasing the downward pressure on future transactions, the price of gold fell on the last trading day.

Spot silver: As of 20:23 Beijing time, spot silver has risen, now trading at 49.095, an increase of 1.38%. In recent intraday trade before the New York opening bell, (silver) prices rose, supported by a positive signal from the relative strength indicator, recouping some of the previous losses, despite the dominance of a sharp bearish correction wave in the short term. With prices trading below the EMA50 and the relative strength indicator reaching excessively overbought levels relative to the price action, the bullish momentum is waning and negative pressure persists.

Crude oil market: As of 20:23 Beijing time, U.S. oil rose, now trading at 61.440, an increase of 5.04%. Prices (crude oil) showed a sharp rise in the latest intraday trade before the New York session, reaching our morning recommended resistance level of $61.75. Due to continued trading above the EMA50 and a short-term break above the major bearish trend line, this rise occurred despite the Relative Strength Index reaching overbought levels, showing the volume and strength of the bullish momentum.

4. Institutional view

ING: The spread of US dollar corporate bonds continues to narrow and is becoming less attractive than Euro bonds

ING credit strategists pointed out in a research report that the credit spread of US dollar corporate bonds is still in an extremely tight state, making it less attractive than similar bonds denominated in euros. Strategists said U.S. credit spreads are likely to widen to reflect current risks, including a worsening labor market, trade tensions and rising fiscal concerns. In addition, investor funds are expected to continue to flow into euro investment-grade bonds, while the scale of fund inflows into U.S. corporate bonds will shrink relatively.

The above content is all about "[XM Foreign Exchange]: German Financial Abyss, Analysis of Short-term Trends of Spot Gold, Silver, Crude Oil and Foreign Exchange on October 23", which is written byThe editor of XM Foreign Exchange carefully www.xmh100.compiled and edited it, hoping it will be helpful to your trading! Thanks for the support!

Live in the present and don’t waste your present life by missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here